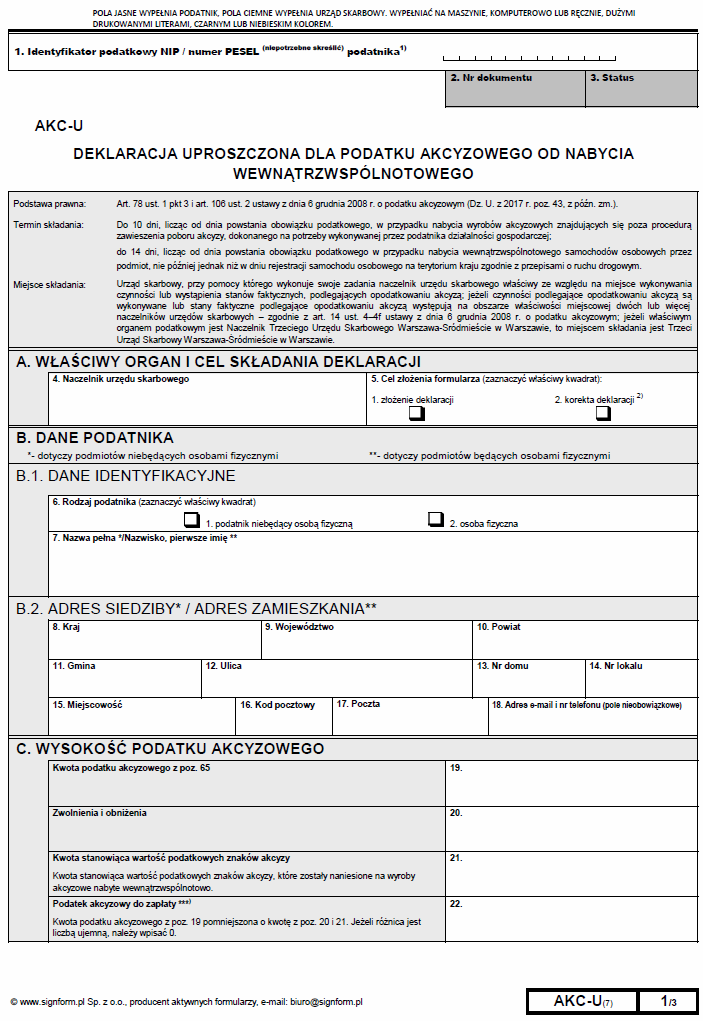

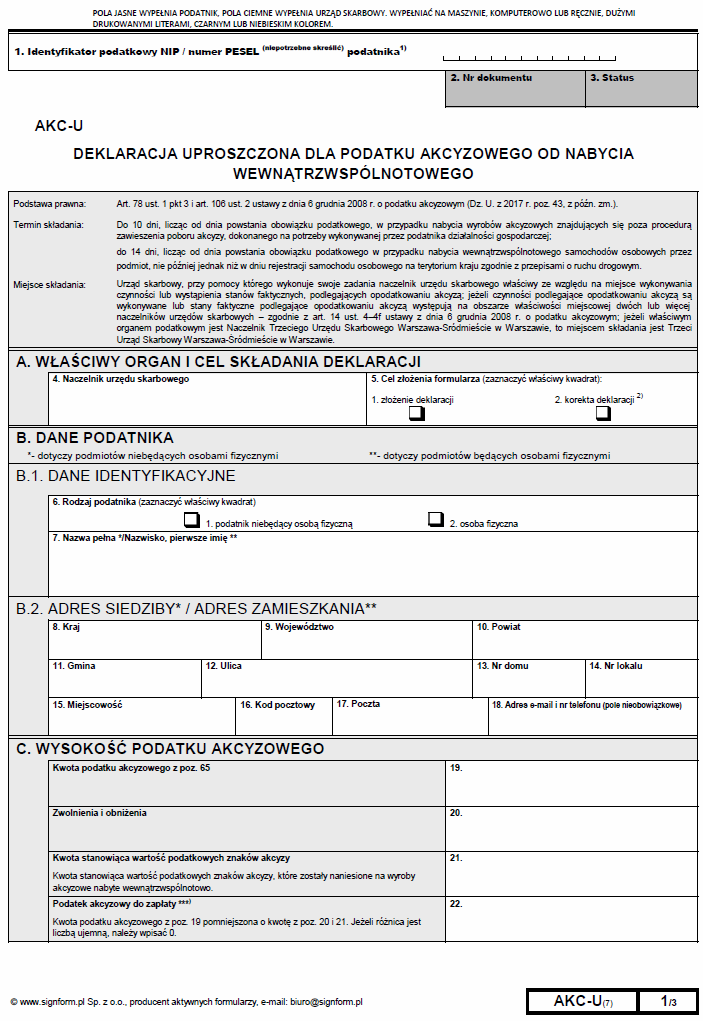

Imported cars - AKC-U declaration

Imported cars - AKC-U declaration

Cars from Germany and French cars turn out to be the most frequently imported vehicles to Poland at the beginning of the year 2010.

In connection with the end of the economic crisis and the strengthening of the Polish currency, there is an increase in the number of used cars imported to the country from Western Europe.. Cars imported, which are replaced in the west with new ones again become attractive to Poles in terms of prices.

However, if we import cars from abroad, we must remember to settle the formalities and fees, and especially about this, to submit a declaration at the customs office AKC-U, that is, detailed information about the imported car. Customs officials sound the alarm and say, that even half of these declarations are not correctly completed or the value of the imported vehicle is underestimated.

In the first two months of this year, the number of AKC-U declarations increased by almost a quarter compared to the same period last year. This is proof of it, That car market imported climbs up. To avoid lowering the value of the car declared in the forms AKC-U each declaration will be thoroughly checked, and the price quoted by the car owner will be verified and compared with a used car price catalog. If the car is undervalued, the taxpayer will be requested to present documentation justifying such and not another purchase price of a car abroad.

Early this year used cars, which were brought to Poland were mostly produced in the years 2000-2004. Most often we import german cars i french cars. Renault was one of the most popular brands, Peugeot, Ford, Audi, BMW and of course Volkswagen. In addition to the low EURO exchange rate, the scale of importing German cars to Poland is also influenced by the system of subsidies operating at our western neighbors promoting the replacement of old cars with new ones..

How to complete the declaration – excise duty on the AKC-U car

In the rubric – Date of the tax obligation – enter the date of crossing the border of the vehicle.

In the rubric – The basis for calculating the tax, enter the price of the car from the contract or invoice.

If the price is in a different currency, e.g. Euro – then we go to the NBP website and check the Euro exchange rate on the day of crossing the border. Let's convert it to zlotys and enter.

In the Tax rate field – if we have an engine up to 2000cc, enter 3,1%.

In the Tax rate field – if we have an engine above 2000cm3, then enter 18,6%.

The tax amount is the result of the multiplication – Tax base X Tax rate.

If we have a car with an engine capacity of up to 2000 cm3 and the price in PLN 10000 PLN – we multiply it times 3,1 then divide the result by 100 and the result comes out 310 PLN – the amount of excise duty per car.

10000 X 3,1 = 31000 : 100 = 310 PLN – Excise duty payable

It is often the case that an official will calculate the excise duty according to the official rates and will increase the value of the excise duty. Then it remains only to agree with him,unless we like to wander around the offices.

Imported cars - AKC-U declaration

Imported cars - AKC-U declaration